It's Time to Lock veTokens Away Forever

An ante mortem on the embarrassing legacy of 2020's generation DAOs.

Vote Escrow is DeFi’s most overblown flop: a failed tokenomics gimmick masquerading as a governance innovation, claiming to “align long-term incentives” and “reward conviction,” but failing at every single property that makes those concepts meaningful, and more.

What is Vote Escrow?

In a few words: a voting weight multiplier for people who lock tokens.

First, we need to establish that this is just one piece of a voting mechanism - the part responsible for determining how much voting weight each member in the community has.

To build a voting mechanism that includes Vote Escrow, you need to pair it with:

Quorum (minimum voting weight needed)

Threshold (how much voting weight to pass?)

Delegation (can people assign voting weight to other people?)

Disputability & Arbitration

Execution

So when we talk about Vote Escrow, we’re really only talking about: how should we decide who has more influence in the community? Vote Escrow’s answer is: “People who locked more governance tokens away for longer.”

This seems reasonable until you remember why people wanted it this way in the first place.

The Design Intent Shows Its Uselessness

Vote Escrow of course wasn’t designed to solve governance problems. It was designed to solve price problems: “How do we prevent people from selling our tokens?”

The solution: convince them to lock tokens in exchange for voting power. If people can’t sell, circulating supply decreases, and theoretically, the number goes up. Vote Escrow proponents then made up the “aligned incentives” and “long-term conviction” narratives after the fact to make financial hostage-taking sound like a governance philosophy.

Of course this isn’t a governance design mindset at all. Real governance is about answering difficult questions like:

How does a community allocate its shared resources most effectively?

How do we get decision-making power to the right people with the right context, and without a centralized authority dictating those terms?

How do we aggregate sentiment to effectively harness collective intelligence?

How do we make decision outcomes predictable so that the community can confidently plan for the future?

How do we prevent coordinated attacks while remaining open and accessible?

If the starting point for your governance solution is “how do we pump the token price?”… you’ve failed before you even started.

The Myth vs. Reality of Vote Escrow

These are real quotes from real people (probably).

Myth: “this is a really hard governance problem we’re voting on. But I made a commitment when I locked my tokens, so it’s my responsibility to research this and get it right.”

Reality: “damn I can’t believe I locked my tokens for 4 years. Ping me when we’re voting to pay out the veToken holders from the treasury.”

Myth: “hell yeah I love this community! It’s a privilege and an honor to lock my tokens up in the name of our shared mission.”

Reality: “hmm it looks like if I click this button, I get 10x voting weight…”

Myth: if people lock their tokens, the token price will go up.

Reality: it absolutely does not.

Myth: if people lock their tokens, everyone will be aligned on long-term success.

Reality: lol… inmates in the same prison are really well-aligned too. I hear those are super collaborative spaces.

Good News: There’s Already a Working Solution

The tragedy is that the real solution for the problems Vote Escrow claims to solve already exists - Conviction Voting - which Vote Escrow is often confused with.

Over 5 years of experience with both mechanisms, I can confidently say Conviction Voting resembles veTokens about as much as Daft Punk Live at the Gorge sounds like the song your dryer plays when it’s done.

Conviction Voting is also just 1 piece of a greater voting mechanism, except this one isn’t about voting weight. Conviction Voting is the time component of a voter’s support for a specific proposal.

In a true Conviction Voting system, conviction grows on proposals to eventually meet support, and that time delay gives people in the community a chance to adjust their support or dispute abusive actions before bad decisions are executed.

The first principles of its design are aimed at solving collective decision-making in a way that mimics other successful complex systems.

It also enables continuous signaling for decisions where community members can express ongoing preference. For certain types of decisions that don’t depend on a deadline, this helps reduce voter workload by not forcing deadline-based decision events on people.

How Actual Conviction Voting works:

Conviction grows on individual proposals. Since it’s not a voting weight system, conviction accumulates on support for specific proposals, not on global decision-making power.

Conviction starts at zero and grows over time. When you support a proposal, your conviction begins at 0 and accumulates the longer you hold that support.

No illiquidity required. Unstake your support on proposals whenever you’d like. They’re your tokens after all - don’t let someone try to convince you otherwise.

Changing your mind still has consequences. Want to support a different proposal? You can switch, but your previous conviction decays over time and your new support starts again at 0. The effects of your prior beliefs linger.

Pair it with any voting weight system. Still really want to make your community lock their governance tokens? Use a locked token multiplier with conviction voting, or try a healthier option like quadratic, fixed, or capped voting weight.

Why does this work?

Time-weighting prevents abuse. The growth and decay curves naturally protect against common forms of gaming in DAOs: last-minute vote swings, coordinated governance attacks, and orchestrated sudden shifts in sentiment, because the community can see upcoming outcomes before they’re executable and take action to change that outcome before it’s too late.

It’s biomimetic. The mechanism mirrors electrical and biological systems that prevent surges and maintain stability amidst anomalies. Conviction Voting brings these successful temporal dynamics to governance.

In this way Conviction Voting measures ongoing commitment and sustained preference. On the other hand, locked token voting multipliers are better measures of degen tendencies and short-sighted thinking - not the best traits to be rewarding with more decision-making power.

How did we get here?

The DeFi space fell in love with Vote Escrow because it was simple to understand and seemed to work for Curve. But “used by successful web3 projects” doesn’t mean “is a successful mechanism.”

What it did create was an entire secondary market of protocols that abstract away the locked positions through liquid wrappers so they can be staked for yield. The ve-ecosystem has grown into a sophisticated workaround to a fundamentally broken design.

To make matters even worse, Vote Escrow punishes long term commitment by depreciating your voting power over the time of your token lock! So your voting power is the greatest in the minute you make the decision to lock, and then evaporates the longer you live with that decision. It’s quite literally the opposite of rewarding commitment.

But at least it supports the price of the token, right?

No!

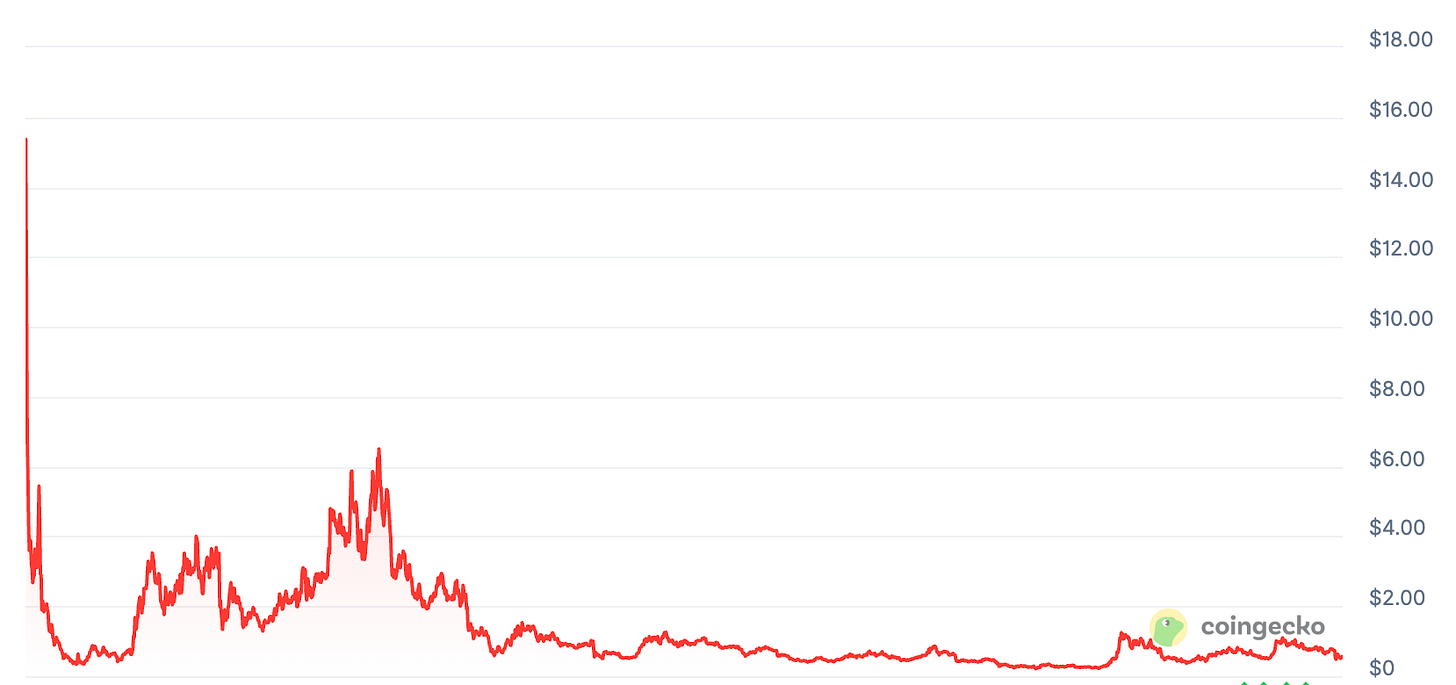

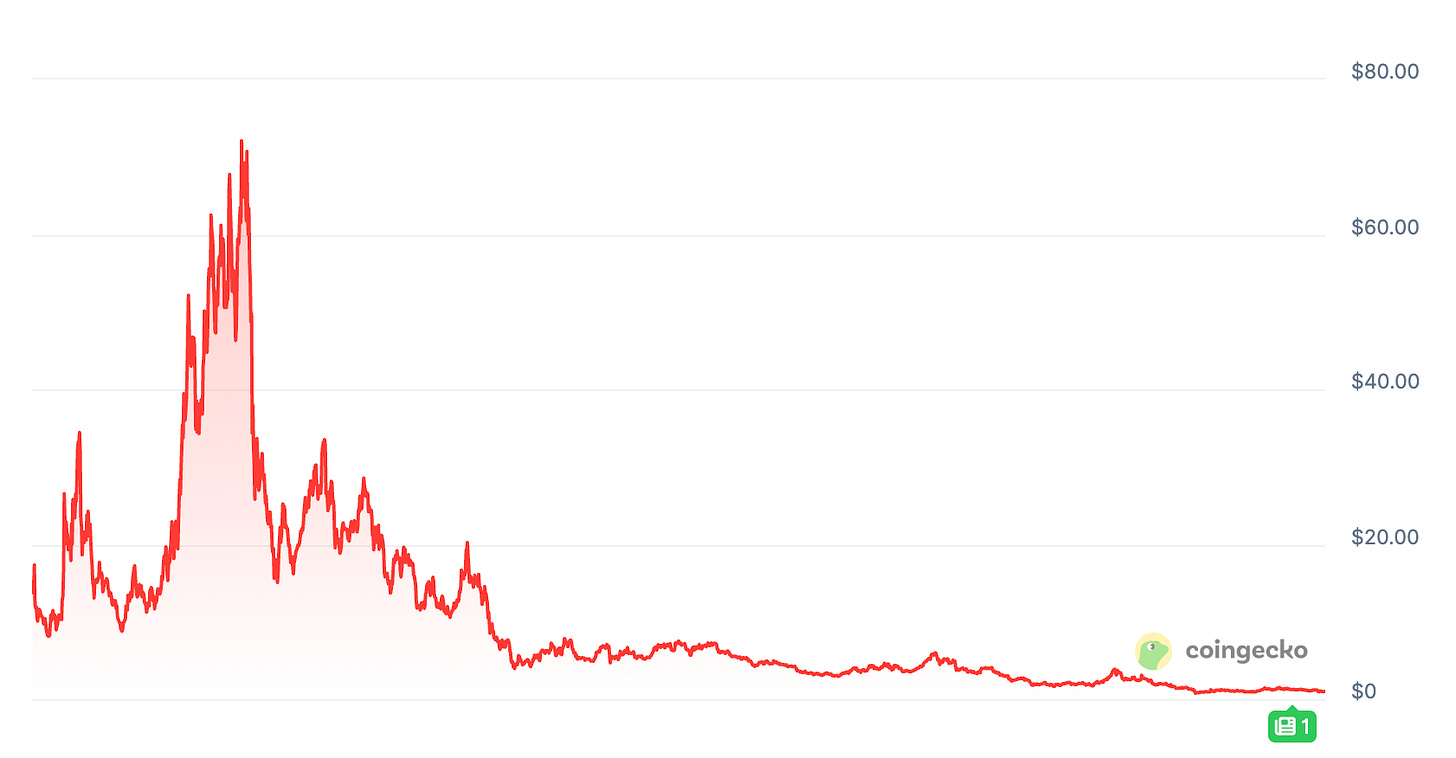

The charts for all the top veTokens (Curve, Balancer, Frax, Convex, PancakeSwap) all look tragically familiar:

Turns out persuading people to lock their governance tokens doesn’t really do much to persuade other people that they should buy them.

So for those of you keeping score:

Vote Escrow doesn’t measure commitment

Vote Escrow doesn’t align long-term incentives

Vote Escrow doesn’t sustain the price of a token

TL;DR

It’s time to lock Vote Escrow in a dark place with its tokens and throw away the keys.

Migrate to Conviction Voting instead.